Atlantic Lithium’s flagship Ewoyaa Project will be a primary source of spodumene concentrate for Piedmont’s Tennessee Lithium operations

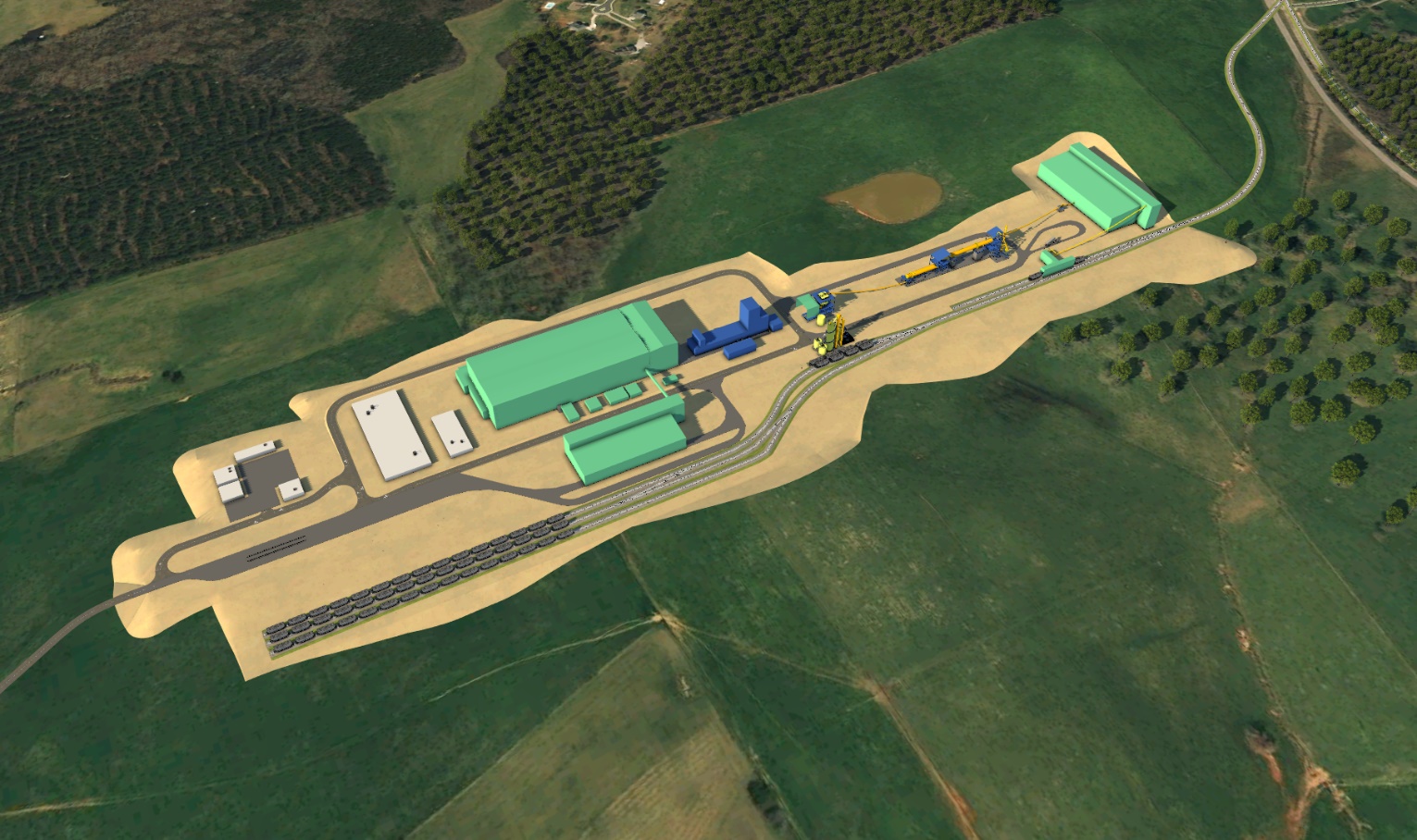

BELMONT, NC, September 27, 2022 – Piedmont Lithium (“Piedmont”, “Company”) (Nasdaq: PLL; ASX: PLL), a leading global developer of lithium resources critical to the U.S. electric vehicle (“EV”) supply chain, today announced that Atlantic Lithium (AIM: ALL; ASX: A11) has completed a prefeasibility study (“PFS”) for Piedmont’s Ghana Project – Atlantic Lithium’s flagship Ewoyaa project located in the Cape Coast region of the country. The PFS demonstrates a production target for the Ghana Project of approximately 255,000 tons per year of 6% lithium spodumene concentrate (“SC6”) over a 12.5-year mine life from Ore Reserves of 18.9 million tons at 1.24% Li2O.

Estimated capital costs for the project increased as part of the PFS. However, Atlantic Lithium expects operating expenditures at the planned production plant to decrease. CAPEX increased from US$70 million to US$125 million. Of the increase, US$27 million is attributed to Atlantic Lithium’s decision to bring crushing in-house for improved operational control and reduced lithium losses.

Piedmont Executive Vice President and Chief Operating Officer Patrick Brindle said he was pleased with the results of the PFS as Piedmont continues to advance plans across its global portfolio of assets. “We expect the project in Ghana to play a critical role in our ability to ramp up production of lithium hydroxide in the United States. This proposed operation is underpinned by high-grade mineral resources, critical infrastructure, access to a deep-water port, and available labor,” explained Brindle. “The study also highlights Atlantic Lithium’s plans related to community engagement and environmental stewardship. The combination of robust economics and commitment to best-practices strengthens our Ghana Project’s position as an industry-leading asset, and we couldn’t be more excited for our partners at Atlantic Lithium.”

Piedmont is earning a 50% interest in Atlantic Lithium’s spodumene projects in Ghana. This agreement includes an offtake agreement for 50% of annual production at market prices on a life-of-mine basis. Piedmont also owns a 9.4% equity interest in Atlantic Lithium.

With the completion of the PFS, the Ghana Project will now advance to the next stage of studies and permitting. Exploration and infill drilling continue as Atlantic Lithium works to submit a mining license application and scoping level environmental and social impact assessment report to the Ghanaian government as next steps.

Atlantic Lithium is working toward a targeted first production of spodumene concentrate in Q3 2024, subject to receipt of a mining license within Q3 2023 and the project meeting all other statutory requirements.

When the Ghana Project is operational, Piedmont plans to import spodumene concentrate from the project to supply the Company’s newly announced Tennessee Lithium project for conversion to lithium hydroxide. The Ghana Project is near the deep-water port of Takoradi, which provides the benefit of simple transport logistics for bringing the material to Piedmont’s Tennessee plant.

Atlantic Lithium has several mechanisms to ensure the sustainable and effective implementation of health, safety, and environmental priorities for both employees and the community surrounding the Ghana Project. This includes documented plans, agreements, toolkits, and registers. Atlantic Lithium has actively engaged community members throughout the development of the project and will continue to do so to educate and inform on project plans, address concerns, and share local employment opportunities.

The statements in the link below were prepared by, and made by, Atlantic Lithium. The following disclosures are not statements of Piedmont and have not been independently verified by Piedmont. Atlantic Lithium is not subject to U.S. reporting requirements or obligations, and investors are cautioned not to put undue reliance on these statements. Atlantic Lithium’s original announcement can be found here.

About Piedmont Lithium

Piedmont Lithium (Nasdaq: PLL; ASX: PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in North America. Our goal is to become one of the largest lithium hydroxide producers in North America by processing spodumene concentrate produced from assets where we hold an economic interest. Our projects include our Carolina Lithium and Tennessee Lithium projects in the United States and partnerships in Québec with Sayona Mining (ASX: SYA) and in Ghana with Atlantic Lithium (AIM: ALL; ASX: A11). These geographically diversified operations will enable us to play a pivotal role in supporting America’s move toward energy independence and the electrification of transportation and energy storage. For more information, visit www.piedmontlithium.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of or as described in securities legislation in the United States and Australia, including statements regarding exploration, development, and construction activities of Atlantic and Piedmont; current plans for Piedmont’s mineral and chemical processing projects; strategy; and strategy. Such forward-looking statements involve substantial and known and unknown risks, uncertainties, and other risk factors, many of which are beyond our control, and which may cause actual timing of events, results, performance or achievements and other factors to be materially different from the future timing of events, results, performance, or achievements expressed or implied by the forward-looking statements. Such risk factors include, among others: (i) that Piedmont or Atlantic Lithium will be unable to commercially extract mineral deposits, (ii) that Piedmont’s or Atlantic Lithium’s properties may not contain expected reserves, (iii) risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), (iv) uncertainty about Piedmont’s ability to obtain required capital to execute its business plan, (v) Piedmont’s ability to hire and retain required personnel, (vi) changes in the market prices of lithium and lithium products, (vii) changes in technology or the development of substitute products, (viii) the uncertainties inherent in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays related to our projects as well as the projects of our partners in Quebec and Ghana, (ix) uncertainties inherent in the estimation of lithium resources, (x) risks related to competition, (xi) risks related to the information, data and projections related to Atlantic Lithium, (xii) occurrences and outcomes of claims, litigation and regulatory actions, investigations and proceedings, (xiii) risks regarding our ability to achieve profitability, enter into and deliver product under supply agreements on favorable terms, our ability to obtain sufficient financing to develop and construct our projects, our ability to comply with governmental regulations and our ability to obtain necessary permits, and (xiv) other uncertainties and risk factors set out in filings made from time to time with the U.S. Securities and Exchange Commission (“SEC”) and the Australian Securities Exchange, including Piedmont’s most recent filings with the SEC. The forward-looking statements, projections and estimates are given only as of the date of this presentation and actual events, results, performance, and achievements could vary significantly from the forward-looking statements, projections and estimates presented in this presentation. Readers are cautioned not to put undue reliance on forward-looking statements. Piedmont disclaims any intent or obligation to update publicly such forward-looking statements, projections, and estimates, whether as a result of new information, future events or otherwise. Additionally, Piedmont, except as required by applicable law, undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Piedmont, its financial or operating results or its securities.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Ore Reserves

The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, “inferred mineral resource”, “ore reserves”, “proven ore reserves” and “probable ore reserves” are terms defined by the U.S. Securities and Exchange Commission (“SEC”) in Regulation S-K, Item 1300 (“S-K 1300”) as well as the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the “JORC Code”). In Atlantic Lithium’s announcement, it indicates that it has prepared resources information in accordance with the standards set forth in the 2012 Edition of the JORC Code. Such standards differ from the requirements of U.S. securities laws that would apply if Atlantic were a reporting company in the United States. Therefore, the mineral resources and ore reserves reported by Atlantic Lithium are not comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. U.S. investors are urged to consider closely the context and nature of Atlantic Lithium’s disclosures in its public communications, as well as the disclosure in Piedmont’s Form 10-KT, a copy of which may be obtained from Piedmont or from the EDGAR system on the SEC’s website at http://www.sec.gov/.