Piedmont Lithium Inc. (“Piedmont” or the “Company”) is pleased to report the results of the updated scoping study (“Scoping Study” or “Study”) for its proposed integrated lithium hydroxide business (“Carolina Lithium” or the “Project”) in Gaston County, North Carolina. The Study confirms that Carolina Lithium will be one of the world’s largest and lowest-cost producers of lithium hydroxide, with a sustainability footprint that is superior to incumbent producers, all in an ideal location to supply the rapidly growing electric vehicle supply chain in the United States.

PROJECT HIGHLIGHTS

Sustainable Lithium Hydroxide Manufacturing

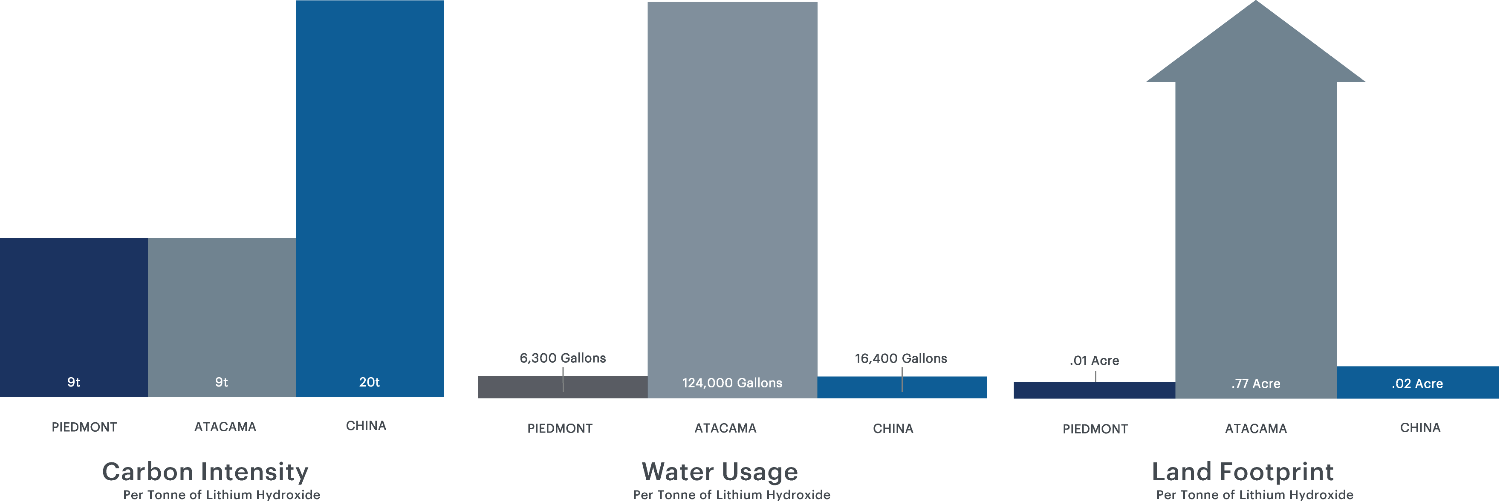

Piedmont Carolina Lithium is expected to have a superior sustainability profile relative to the current producers based in China and South America. Chinese lithium producers are highly reliant on coal-fired power and generally utilize a carbon-intensive sulfuric acid roasting process to convert raw materials shipped in from Australia, while South American producers tend to utilize vast tracts of land and large quantities of water, all in the driest desert in the world, the Atacama.

- Metso Outotec process reduces emissions, eliminates sulfuric acid roasting, and reduces solid waste

- Solar power generation, in-pit crushing, and electric conveying reduce reliance on carbon-based energy sources

- Vastly diminished transportation distances for raw materials and finished product

- Highly efficient land and water use compared with South American brine production

- Far lower CO2 intensity than incumbent China hydroxide production including Scope 1, 2, and 3 emissions

- Independent preliminary Life-Cycle Analysis (“LCA”) completed with Minviro

Figure 1 – Life cycle analysis of key carbon intensity, water usage, and land footprint of Piedmont Carolina Lithium

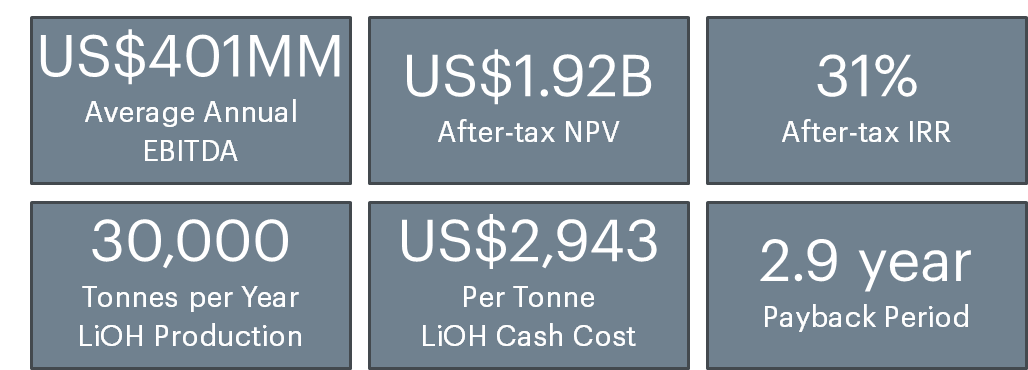

Exceptional Economics and Scale

The Study confirms that Piedmont will be a large and low-cost producer of lithium hydroxide, benefitting from its ideal location in Gaston County, North Carolina, with exceptional infrastructure, a deep local talent pool, low-cost energy, and proximity to local markets for the monetization of by-product industrial minerals. The Study results represent a substantial improvement over prior studies despite the use of more conservative assumptions related to mining dilution and metallurgical recoveries.

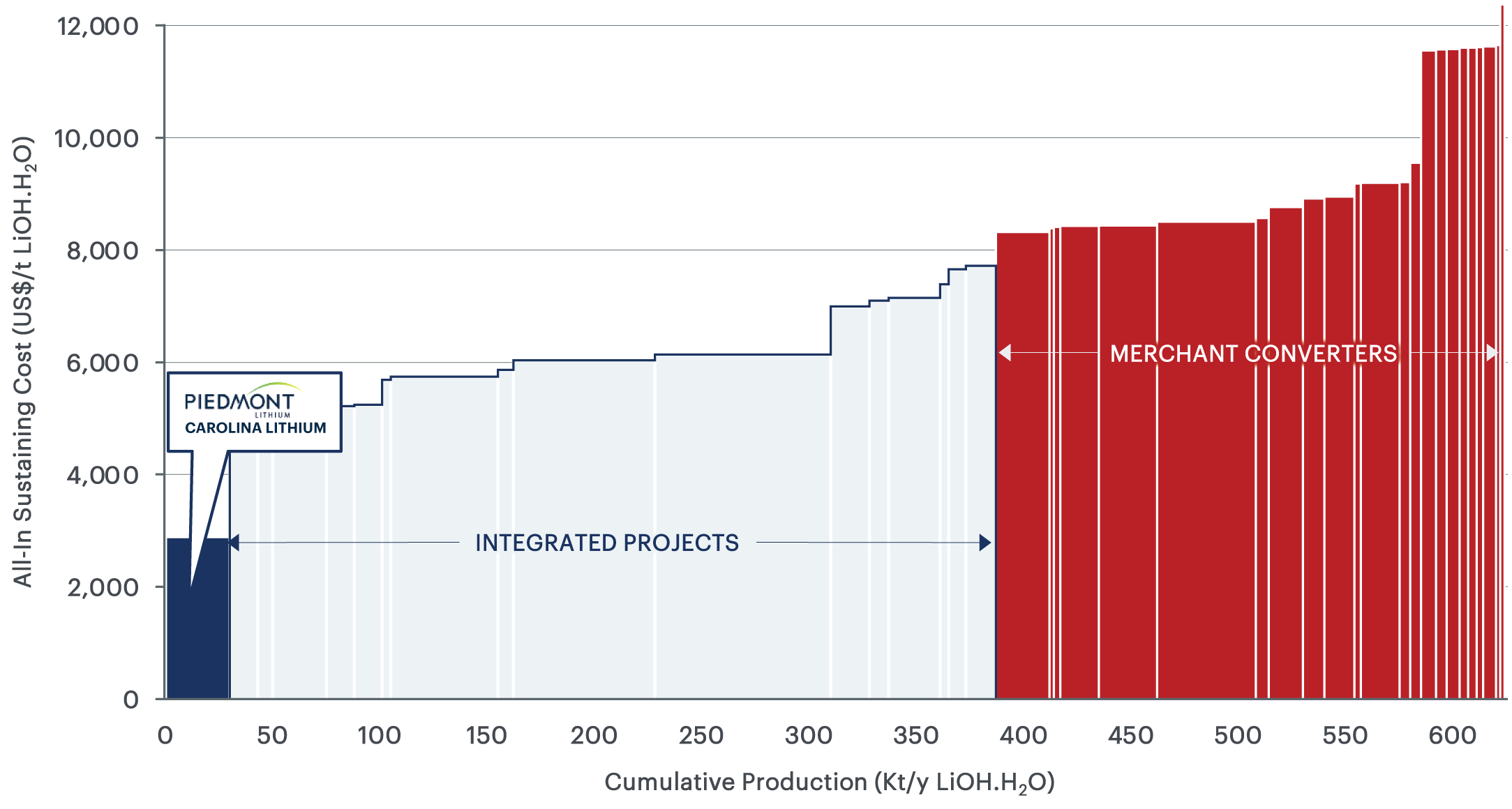

The competitive advantage of Piedmont’s unique location is depicted in the following lithium hydroxide cost curve, which was prepared by Roskill, a leading lithium industry consultancy.

Figure 2 – Lithium hydroxide 2028 AISC cost curve (real basis) (Roskill)

AISC includes all direct and indirect operating costs including feedstock costs (internal AISC), refining, corporate G&A and selling expenses.

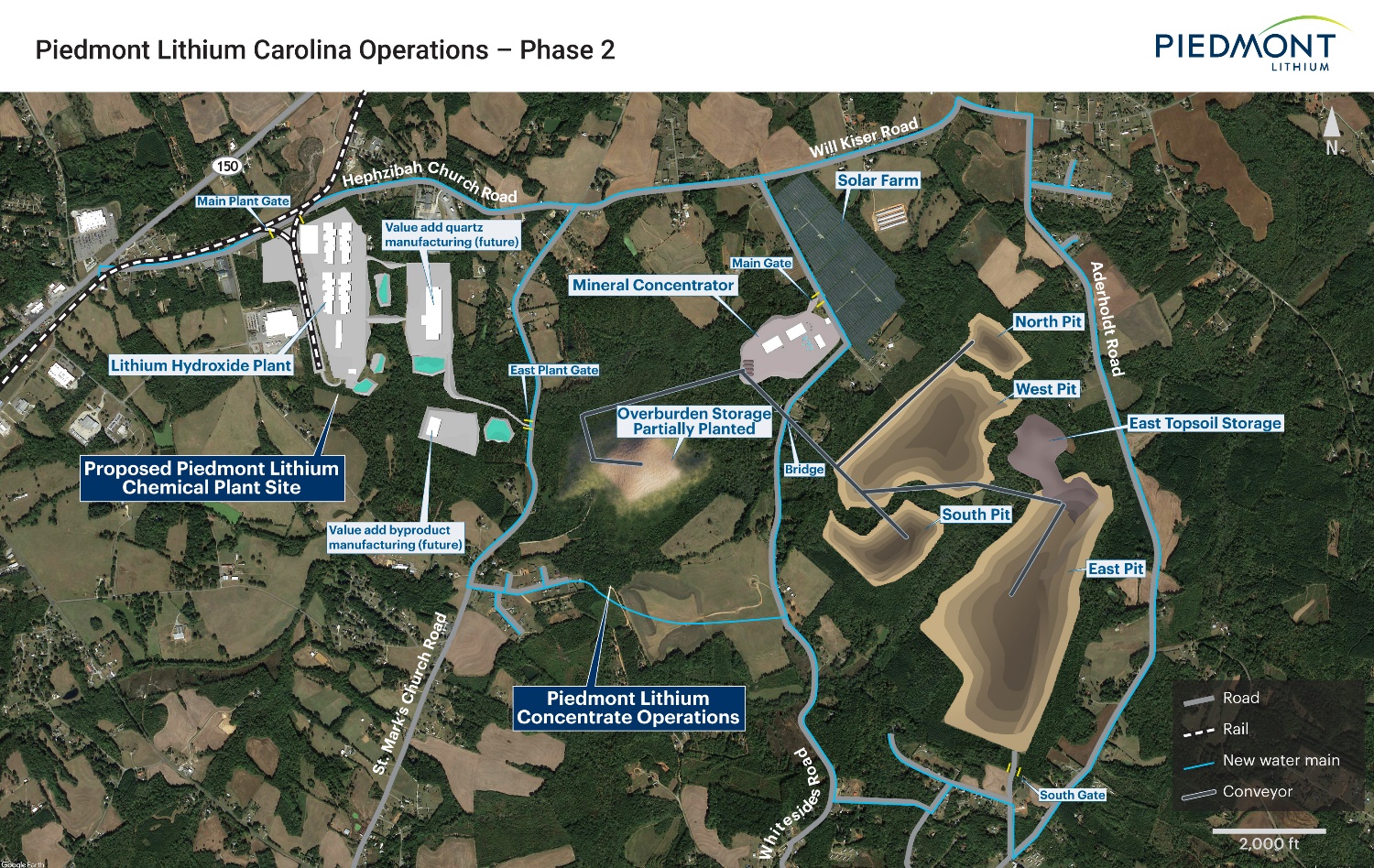

Fully Integrated Manufacturing Campus

Piedmont Carolina Lithium contemplates a single, integrated site, comprising quarrying, spodumene concentration, by-products processing, and spodumene conversion to lithium hydroxide. There are currently no such integrated sites operating anywhere in the world, and the economic and environmental advantages of this strategy are compelling:

- Premier location in Gaston County, North Carolina – “the cradle of the lithium business”

- Elimination of SC6 transportation costs and related noise and emissions

- On-site solar complex to power concentrate operations and reduce reliance on diesel fueled equipment

- Potential to co-locate other downstream battery materials / Li-ion battery manufacturing

- Creation of up to 500 manufacturing, engineering, and management jobs

- Site offers potential to expand hydroxide capacity by adding additional manufacturing trains in the future

Figure 3 – Indicative proposed site plan for Piedmont’s Carolina Lithium operations

“We are exceedingly pleased with the results of our updated Scoping Study. The economics of our Project continue to impress, but I am particularly proud of the Project’s sustainability profile. Customers, investors, and neighbors are increasingly focused on businesses that are “doing things the right way.” It is critical that raw material supply chains do not detract from the overall sustainability of the transition to electric vehicles. Our project will have a far lower environmental footprint than alternative suppliers, and we expect that to position Piedmont well with all stakeholders.

As we move forward to complete a Definitive Feasibility Study for Carolina Lithium later in 2021, Piedmont has engaged Evercore and JPMorgan as financial advisors to evaluate potential strategic partnering and financing options for its North Carolina Project. Given the Project’s unique position as the only American spodumene project, with world-class scale, economics, and sustainability, we expect strategic interest to be robust.

Keith D. Phillips, President and Chief Executive Officer

scoping study update

Piedmont’s Carolina Lithium Scoping Study Update is based on the Company’s Mineral Resource estimate reported in April 2021, of 39.2 Mt at a grade of 1.09% Li2O and the by-product Mineral Resource estimates comprising 7.4 Mt of quartz, 11.1 Mt of feldspar and 1.1 Mt of mica reported in June 2021.

The fully integrated Study contemplates a 20-year project life, with the downstream lithium hydroxide chemical plant commencing 90 days after the start of concentrate operations. The chemical plant is assumed to achieve full capacity within 12 months. Table 1 provides a summary of production and cost figures for the integrated Project.

|

Unit |

Estimated Value | |

|---|---|---|

|

Annual Production | ||

|

Operation life |

years |

20 |

|

Steady state annual lithium hydroxide production |

t/y |

30,000 |

|

Average annual spodumene concentrate (SC6) production |

t/y |

248,000 |

|

Average annual quartz production |

t/y |

252,000 |

|

Average annual feldspar production |

t/y |

392,000 |

|

Average annual mica production |

t/y |

70,000 |

|

Life-of-Mine (“LOM”) Production | ||

|

Production target |

Mt |

37.41 |

|

LOM SC6 production |

Mt |

4.96 |

|

LOM quartz production |

Mt |

4.83 |

|

LOM feldspar production |

Mt |

7.51 |

|

LOM mica production |

Mt |

1.34 |

|

LOM feed grade (excluding dilution) |

% |

1.09 |

|

LOM average concentrate grade |

% |

6.0 |

|

LOM average process recovery |

% |

80 |

|

LOM average strip ratio |

waste:ore |

12.2:1 |

|

Operating and Capital Costs | ||

|

Average LiOH production cash costs |

US$/t |

$2,943 |

|

Average LiOH production all in sustaining costs |

US$/t |

$3,145 |

|

Direct development capital |

US$MM |

$639.0 |

|

Land acquisition costs |

US$MM |

$28.0 |

|

Other owner’s costs |

US$MM |

$43.8 |

|

Contingency |

US$MM |

$127.8 |

|

Total initial capital cost |

US$MM |

$838.6 |

|

Sustaining and deferred capital |

US$MM |

$337.9 |

|

Working capital |

US$MM |

$48.3 |

|

Financial Performance | ||

|

Average annual steady state EBITDA |

US$MM/y |

$401 |

|

Average annual steady state after-tax cash flow |

US$MM/y |

$315 |

|

After tax Net Present Value (“NPV”) @ 8% discount rate |

US$MM |

$1,923 |

|

After tax Internal Rate of Return (“IRR”) |

% |

31% |

|

Payback from start of operations |

years |

2.9 |

Updates from Prior Studies

Notable improvements to business outcomes have been achieved in this Study compared with the prior scoping study published in May 2020. Key updates are reflected in Table 2.

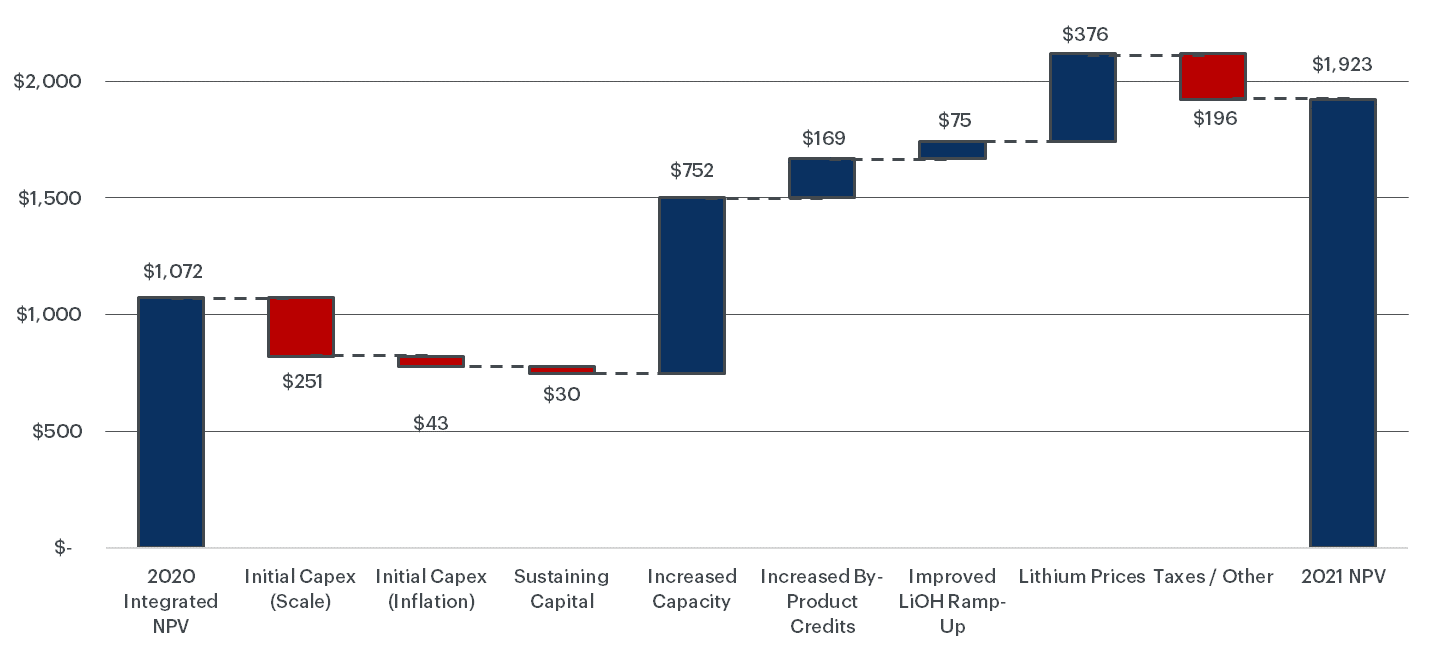

Figure 4 shows the impact of key project changes to Project NPV.

Figure 4 – Updated economic model impact to NPV8 on the Carolina Lithium Project (US$ Billion)

These improved results for the proposed operations have been achieved based on changes to the project design:

Production values have been modified

- Run-of-mine ore production increased to 1.95Mt/y from 1.15 Mt/y

- SC6 production increased to 248,000 t/y from 160,000 t/y

- LiOH production increased to 30,000 t/y from 22,720 t/y

- Quartz production increased to 252,000 t/y from 86,000 t/y

- Feldspar production increased to 392,000 t/y from 125,000 t/y

- Mica production increased to 70,000 t/y from 13,000 t/y

Process and infrastructure improvements

- Metso Outotec alkaline pressure leach replaces acid roasting lithium conversion process

- In pit crushing and conveyor systems have eliminated mining trucks

- Solar generating capacity added to project

- Expanded by-products capacity

Capital costs have been updated based on technology changes, project scale, and inflation impacts

Fixed infrastructure investment enhances emissions profile and reduces long-term operating costs

Product pricing has been updated to 2021 long-term forecasts for LiOH, SC6, and by-products

Environment, Sustainability, and Governance

Over the past year, the Company has taken steps to improve upon the advantages present in North Carolina. Minviro, an industry-leading practitioner of Life Cycle Assessment (LCA) impacts of manufacturing battery materials was engaged by Piedmont to complete a prospective LCA of the integrated lithium hydroxide operations. Together with Minviro, Piedmont has enhanced our sustainability footprint by implementing the following initiatives in our Study update:

- Working with a solar developer to build and operate a solar farm on Piedmont property capable of producing electricity to supply up to 100% of Piedmont needs

- Utilizing electric equipment to the greatest extent possible including transporting ore from pit operations to the concentrator to reduce fossil fuel consumption

- Co-locating all operations on the same proposed site in Gaston County minimizing any transit and allowing unused by-products streams to be repurposed for site redevelopment

- Expanding the by-products operations to serve valuable markets for quartz, feldspar and mica

Minviro worked with Piedmont to identify areas for improvement in operations on a cradle-to-gate basis using the work that Piedmont completed in prior studies. Piedmont is now setting a target to produce lithium hydroxide with a carbon intensity of less than 9 kg of CO2-e/Kg of lithium hydroxide including complete Scope 1, 2 and upstream Scope 3 emissions. This target is nearly half of the carbon intensity of incumbent producers of lithium hydroxide starting with spodumene mined in Western Australia and chemically refined in China. It is on par with brine-based production routes to lithium hydroxide which require considerable quantities of reagents to be transported by ocean going vessels and supplies of fresh water in a water scarce region.

Scoping Study Consultants

This Scoping Study update combines information and assumptions provided by a range of independent consultants, including the following consultants who have contributed to key components of the Study.

|

Table 3: Scoping Study Consultants | |

|

Consultant |

Scope of Work |

|

Primero Group Limited |

Concentrate operations and overall Study integration |

|

Metso Outotec |

Lithium hydroxide manufacturing technology package |

|

SGS Lakefield |

Metallurgical testwork |

|

Marshall Miller and Associates |

Mine design and scheduling |

|

McGarry Geoconsulting Corp. |

Mineral Resource estimation |

|

Minviro |

Life Cycle Analysis |

|

HDR Engineering, Inc. |

Permitting, environment, and social studies |

|

Johnston, Allison, and Hord |

Land title and legal |

|

Benchmark Mineral Intelligence |

Lithium products marketability |

|

John Walker |

By-products marketability |

Scoping Study Overview

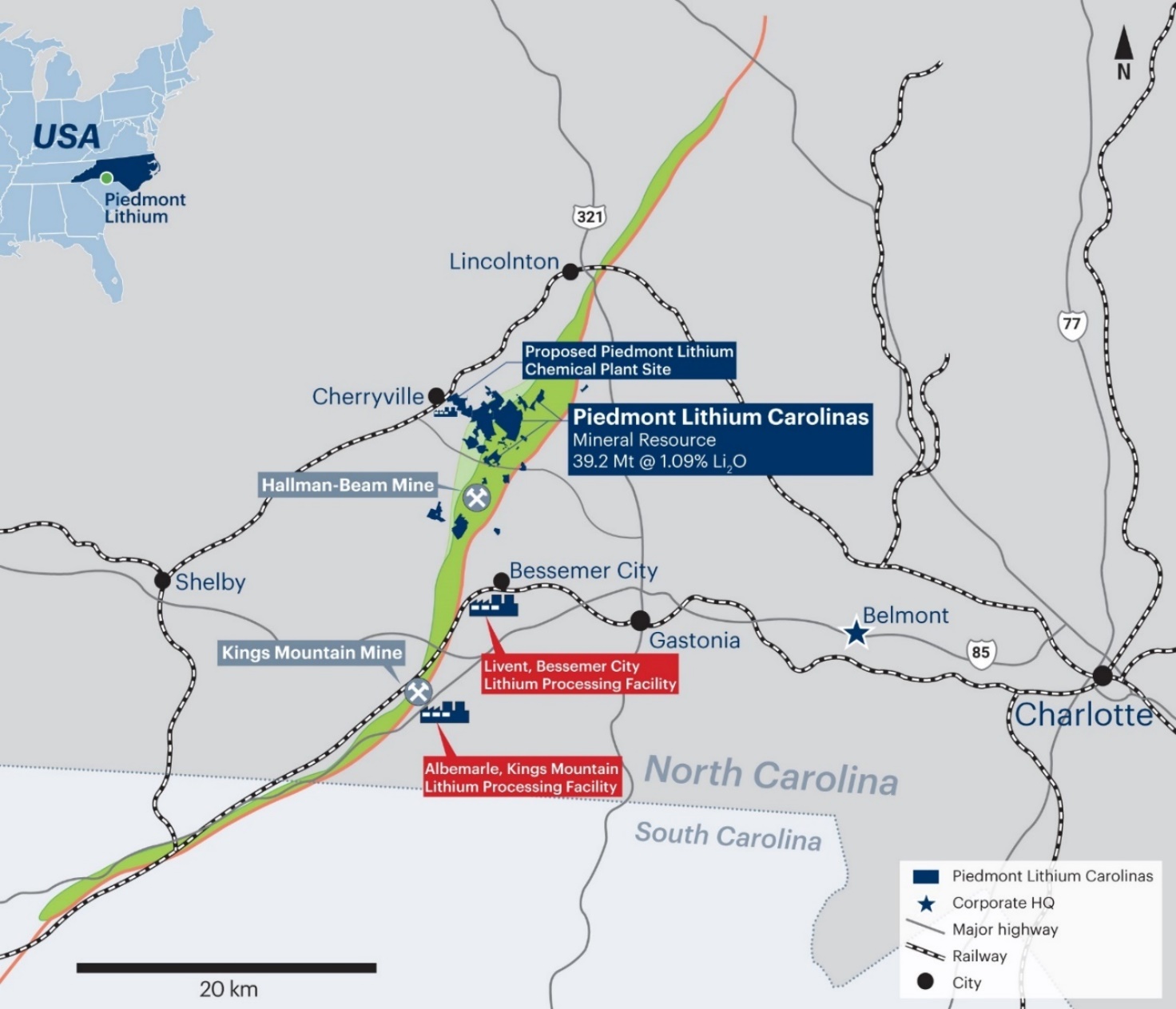

Piedmont holds a 100% interest in the Carolina Lithium Project located within the Carolina Tin-Spodumene Belt (“TSB”) and along trend to the Hallman Beam and Kings Mountain mines, which historically provided most of the western world’s lithium between the 1950s and the 1980s. The TSB has been described as one of the largest hard rock lithium regions in the world and is located approximately 25 miles west of Charlotte, North Carolina.

The Company has reported Mineral Resource estimates (“MRE”) for the Project. Piedmont has completed 495 drill holes on these properties totaling 82,924 meters to date spanning four drill campaigns.

As of March 31, 2021, the Project comprised approximately 2,667 acres of surface property and associated mineral rights, of which approximately 988 acres are owned, approximately 113 acres are subject to long-term lease, approximately 79 acres are subject to lease-to-own agreements, and approximately 1,487 acres are subject to exclusive option agreements. These exclusive option agreements, upon exercise, allows Piedmont to purchase or, in some cases, enter into long-term lease agreements for the surface property and associated mineral rights.

Figure 5 – Piedmont’s location within the TSB

Mineral Resource Estimates

On April 8, 2021 the Company announced an updated MRE prepared by independent consultant McGarry Geoconsulting Corp. (“McGarry Geo”) in accordance with JORC Code (2012 Edition). The total lithium Mineral Resources reported by Piedmont for the Carolina Lithium Project are 39.2 Mt grading at 1.09% Li2O.

|

Table 4: Piedmont Carolina Lithium Mineral Resources Estimate | ||||

|

Resource Category |

Tonnes (Mt) |

Grade (Li2O%) |

Li2O (t) |

LCE (t) |

|

Indicated |

21.6 |

1.12 |

241,000 |

597,000 |

|

Inferred |

17.6 |

1.03 |

181,000 |

449,000 |

|

Total |

39.2 |

1.09 |

422,000 |

1,046,000 |

On June 8, 2021 the Company announced updated MREs for by-products quartz, feldspar, and mica. The results are shown in Table 5. The by-product MRE’s have been prepared by independent consultants, McGarry Geo and are reported in accordance with the JORC Code (2012 Edition). The economic extraction of by-product minerals is contingent on Piedmont’s economic extraction of lithium Mineral Resources. Accordingly, the by-product Mineral Resource estimates are reported at a 0.4% Li2O cut-off grade, consistent with the reported lithium MRE.

|

Category |

Tonnes (Mt) |

Li2O |

Quartz |

Feldspar |

Mica | ||||

|

Grade |

Tonnes |

Grade |

Tonnes (Mt) |

Grade |

Tonnes (Mt) |

Grade |

Tonnes (Mt) | ||

|

Indicated |

21.6 |

1.12 |

241,000 |

29.4 |

6.34 |

45.0 |

9.69 |

4.2 |

0.90 |

|

Inferred |

17.6 |

1.03 |

181,000 |

29.3 |

5.16 |

45.9 |

8.08 |

4.1 |

0.73 |

|

Total |

39.2 |

1.09 |

422,000 |

29.4 |

11.50 |

45.4 |

17.77 |

4.2 |

1.63 |

Production Target

Pit optimizations were completed by Marshall Miller in order to produce a production schedule on an annual basis. This resulted in a total production target of approximately 4.96 Mt of 6.0% Li2O spodumene concentrate (“SC6”), averaging approximately 248,000 t/y of SC6 over the 20-year mine life. This equates to an average of 1.95 Mt/y of ore processed, totaling approximately 37.4 Mt of run-of-mine (“ROM”) ore at an average ROM grade of 1.09% Li2O (undiluted) over the 20-year mine life.

The Study assumes concentrate operations and chemical plant operations production life of 20 years, commencing in year 1 of the Project. It is assumed that concentrate operations including by-products will commence about 90 days in advance of chemical plant start-up to build initial SC6 inventory. SC6 produced in excess of chemical plant requirements are assumed to be sold to third parties during the life of the Project. Of the total production target of 4.96 Mt of SC6, approximately 1.19 Mt will be sold to third parties during the operational life and approximately 3.77 Mt will be supplied to Piedmont’s chemical plant operations for conversion into lithium hydroxide, resulting in a total production target of approximately 582,000 t of lithium hydroxide, averaging approximately 29,095 t/y of lithium hydroxide over the 20-year production life.

Of the 582,000 t lithium hydroxide production target 567,000 t are expected to be sold as battery-grade quality lithium hydroxide with 15,000 t sold as technical-grade quality based on the estimated ramp-up of the lithium chemical plant.

The Study assumes production targets of 4.83 Mt of quartz concentrate, 7.51 Mt of feldspar concentrate, and 1.34 Mt of mica concentrate over the life of operations based on the potential recovery of these products from the concentrator flotation circuits and the Company’s analysis of domestic industrial minerals markets and engagement with prospective customers.

There remains significant opportunity to increase the operational life of Carolina Lithium beyond 20 years by discovery of additional resources within the TSB within a reasonable trucking or conveying distance to the proposed concentrator.

Mining

Independent consultants Marshall Miller and Associates used SimSched™ software to generate a series of economic pit shells using the updated Mineral Resource block model and input parameters as agreed by Piedmont. Overall slope angles in rock were estimated following a preliminary geotechnical analysis that utilized fracture orientation data from oriented core and downhole geophysics (Acoustic Televiewer), as well as laboratory analysis of intact rock strength. The preliminary geotechnical assessment involved both kinematic and overall slope analyses utilizing Rocscience™ modeling software.

Overall slope angles of 45 degrees were assumed for overburden and oxide material. Overall slope angles of 53 degrees were estimated for fresh material which includes a ramp width of 30 meters. Production schedules were prepared for the Project based on the following parameters:

- A targeted run-of-mine production of 1.95 Mt/y targeting concentrator output of about 248,000 t/y of SC6

- Mining dilution of 10%

- Mine recovery of 100%

- Concentrator processing recovery of 80%

- Mine sequence targets maximized utilization of Indicated Mineral Resources at the front end of the schedule

The results reported are based upon a scenario which maximizes extraction of Indicated Resources in the early years of production. Indicated resources represent 100% of the tonnes processed in years 1-3 of operations. The results reported assume that the Core property is mined from year 1-17 with the Central property mined in years 17-19 and the Huffstetler property mined in years 19-20. Table 6 shows the production target.

|

Property |

ROM Tonnes Processed (kt) |

Waste Tonnes Mined (kt) |

Stripping Ratio (W:O t:t) |

ROM Li2O Diluted Grade (% ) |

Production Years |

Tonnes of SC6 (kt) |

|---|---|---|---|---|---|---|

|

Core |

30,593 |

378,603 |

12.4 |

0.99 |

1-17 |

4,050 |

|

Central |

4,251 |

49,467 |

11.6 |

1.12 |

17-19 |

632 |

|

Huffstetler |

2,564 |

28,511 |

11.1 |

0.81 |

19-20 |

278 |

|

Total |

37,408 |

456,581 |

12.2 |

0.99 |

1-20 |

4,960 |

Concentrate Metallurgy

Piedmont engaged SGS Canada Inc. in Lakefield, Ontario to undertake testwork on variability and composite samples. Dense Medium Separation (“DMS”) and locked-cycle flotation tests produced high-quality spodumene concentrate with a grade above 6.0% Li2O, iron oxide below 1.0%, and low impurities from composite samples. Table 7 shows the results of composite tests on the preferred flowsheet which were previously announced on July 17, 2019. The feed grade of the composite sample was 1.11% Li2O.

This Study assumes a spodumene recovery of 80% when targeting a 6.0% Li2O spodumene concentrate product. The Company is currently undertaking additional variability sample testing concurrent with ongoing Definitive Feasibility Study (“DFS”) activities.

By-Product Metallurgy

The production of bulk quartz and feldspar concentrates as by-products from the spodumene locked-cycle flotation tailings was investigated. Six individual batch tests were conducted with the quartz and feldspar concentrates being composited. The results of these tests are provided in Table 8 (results previously announced May 13, 2020). Additional by-product testwork in conjunction with DFS is ongoing.

Piedmont engaged North Carolina State University’s Minerals Research Laboratory in 2018 to conduct bench-scale testwork on samples obtained from the Company’s MRE within the Core Property for by-products quartz, feldspar, and mica. The objective of the testwork program was to develop optimized conditions for spodumene flotation and magnetic separation for both grade and recovery. Summary mica concentrate data are shown in Table 9. Complete mica data were previously announced on September 4, 2018. Further mica product optimization is in progress in conjunction with the DFS.

|

Parameter |

Unit |

Optimized Value |

|

Particle Size |

Medium to Very Fine |

40 – 635 Mesh |

|

Bulk Density |

g/cm3 |

0.681 – 0.682 |

|

Grit |

% |

0.70 – 0.79 |

|

Photovoltmeter |

Green Reflectance |

11.2 – 11.6 |

|

Hunter Value |

± a [Redness(+) Greenness(-)] |

0.27 – 1.25 |

|

Hunter Value |

± b [Yellowness(+) Blueness(-)] |

44.77 – 46.07 |

Mica quality is measured by its physical properties including bulk density, grit, color/brightness, and particle size. The bulk density of mica by-product generated from Piedmont composite samples was in the range of 0.680 – 0.682 g/cm3.

The National Gypsum Grit test is used mostly for minus 100 mesh mica which issued as joint cement compound and textured mica paint. Piedmont sample grit results were in the range of 0.70 – 0.79%, well below the typical specification for total grit in mica of 1.0%. Color/brightness is usually determined on minus 100 mesh material. Several instruments are used for this determination including the Hunter meter, Technedyne and the Photovoltmeter. The green reflectance is often reported for micas and talcs. Piedmont Green Reflectance results were in the range of 11.2 – 11.6.

Process Design

The concentrator process design is based on prior SGS testwork. Flowsheet optimization is ongoing with a variability testwork program at SGS in conjunction with the Company’s definitive feasibility study. Lithium hydroxide manufacturing process design is based on Metso Outotec experience. A pilot-scale testwork program is currently underway to confirm process design as part of the Company’s ongoing definitive feasibility study.

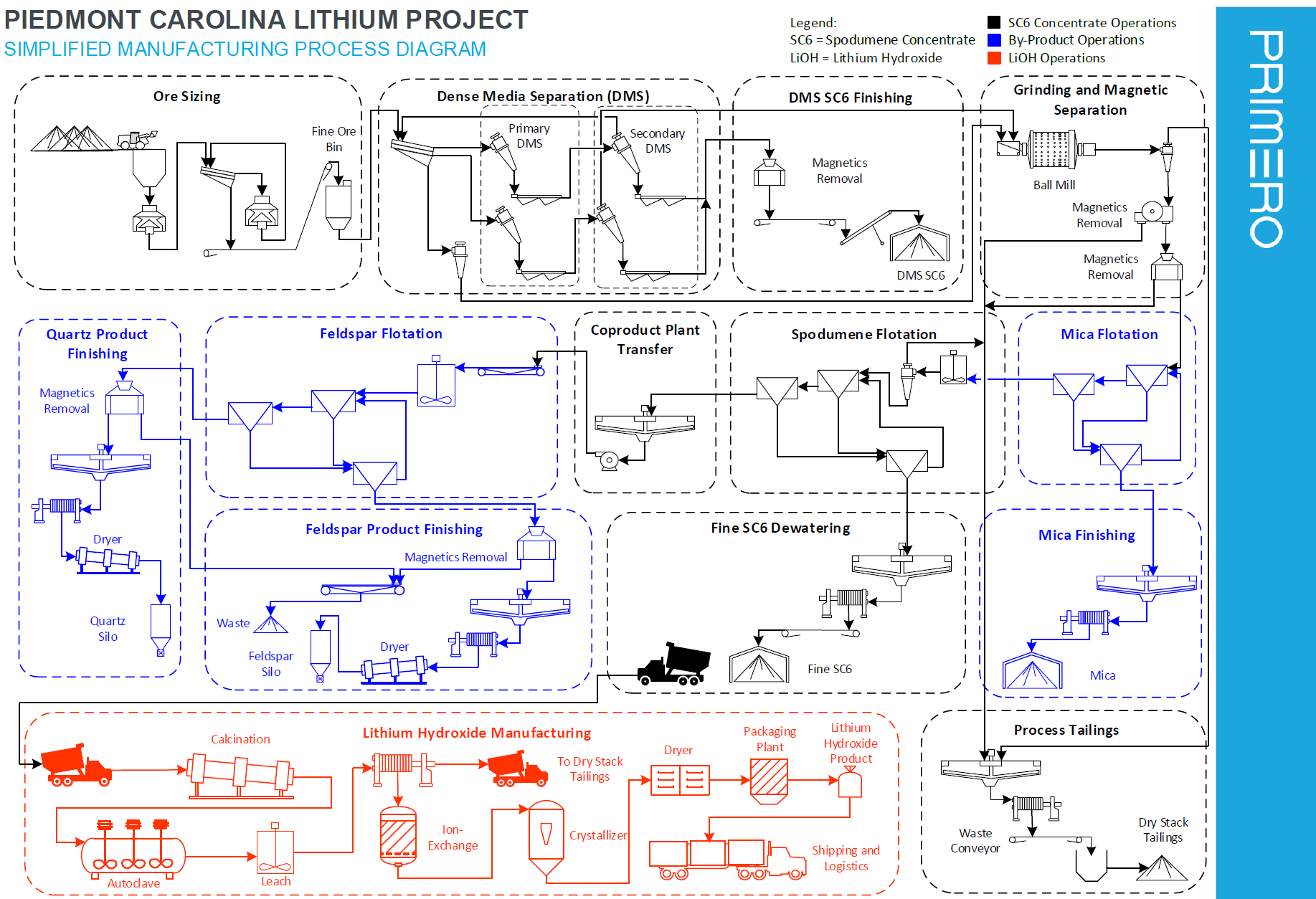

The simplified process flow diagram for the Project is shown in Figure 6.

Figure 6 – Proposed Carolina Lithium Project block flow diagram

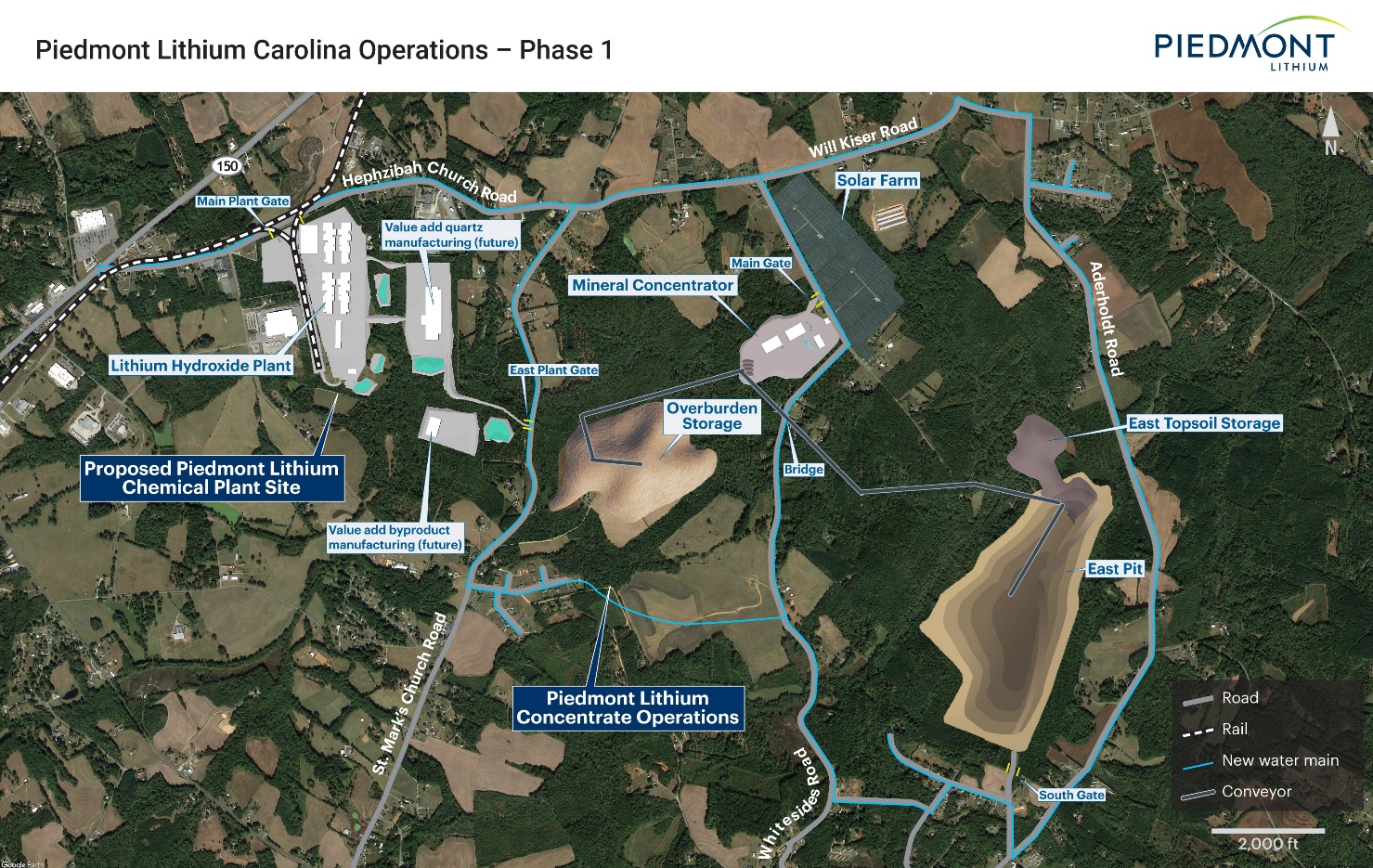

Site Plan

A preliminary integrated site plan including mining operations, concentrate operations, lithium hydroxide manufacturing, overburden and waste rock disposal, by-product manufacturing and ancillary facilities was developed by Marshall Miller and Primero Group during the course of study. Figure 7 shows the indicative site plan for the proposed integrated manufacturing campus.

Figure 7 – Proposed integrated manufacturing campus site plan

Infrastructure

Piedmont enjoys a superior infrastructure position relative to most lithium projects globally. The proposed site is approximately 25 miles west of Charlotte, North Carolina. The site is directly accessible by multiple state highways, CSX railroad, and is in close proximity to U.S. Highway 321 and U.S. Interstate I-85.

Piedmont’s proposed Carolina Lithium operations are in proximity to four (4) major US ports:

- Charleston, SC – 197 miles

- Wilmington, NC – 208 miles

- Savannah, GA – 226 miles

- Norfolk, VA – 296 miles

Charlotte-Douglas International Airport is 20 miles from the proposed operations. Charlotte-Douglas is the 6th largest airport in the United States and has direct international routes to Canada, the Caribbean, South America, and Europe.

Temporary or permanent camp facilities will not be required as part of the Project. Furthermore, Livent Corporation and Albemarle Corporation operate lithium chemical plants in close proximity to the proposed Piedmont operations, and the local region is well serviced by fabrication, maintenance, and technical service contractors experienced in the sector.

Logistics

Most spodumene concentrate produced by Piedmont will be consumed by the Piedmont Carolina Lithium chemical plant. For internal transportation costs within the integrated campus a US$2.00/t cost is included in the financial model for the internal site transport between the concentrate operations and chemical plant.

Permitting

HDR Engineering has been retained by Piedmont to support permitting activities on the proposed Project.

In November 2019, the Company received a Clean Water Act Section 404 Standard Individual Permit from the US Army Corps of Engineers for the concentrate operations. This is the only federal permit required for the concentrate operations. The Company has also received a Section 401 Individual Water Quality Certification from the North Carolina Division of Water Resources.

The concentrate operations require a North Carolina State Mining Permit from the North Carolina Department of Environmental Quality (“NCDEQ”) Division of Energy, Mineral and Land Resources. A permit application is well advanced and will be submitted to North Carolina following additional pre-application consultation over the coming months.

Piedmont previously received a Clean Air Act Title V synthetic minor permit from the NCDEQ Division of Air Quality for a proposed lithium hydroxide operation in Kings Mountain. Piedmont will apply for a new Title V synthetic minor air permit for the proposed Gaston County chemical plant location in the coming months.

The overall proposed integrated Project remains subject to conditional district rezoning within Gaston County. A rezoning application will proceed following additional pre-application consultation with Gaston County and community leaders following publication of the Study results.

Marketing

Lithium Market Outlook

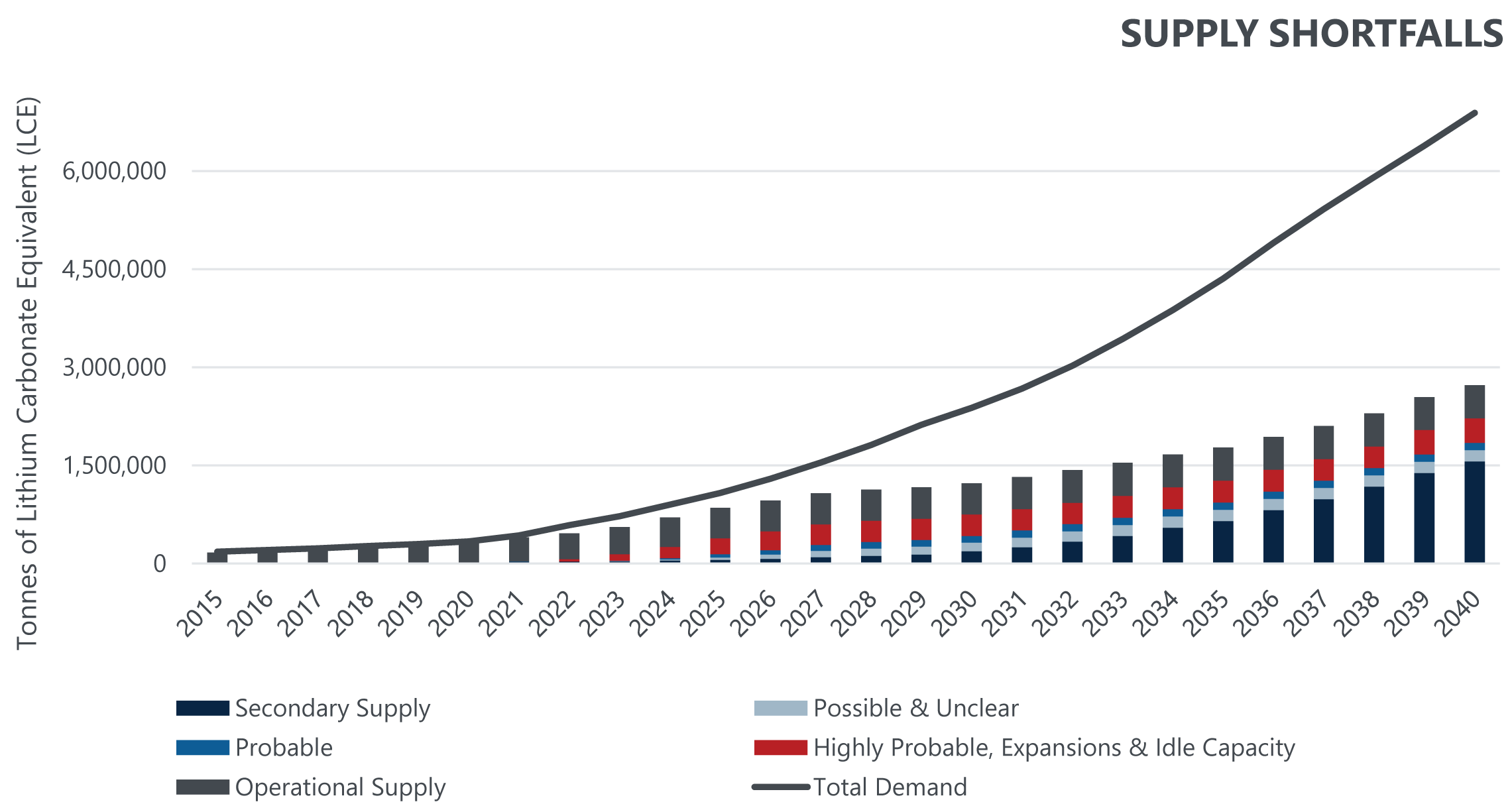

Benchmark Mineral Intelligence (“Benchmark”) reports that total battery demand will grow to 312 GWh in 2021 translating to 297kt of LCE demand in 2021, a growth of 41% over 2020 demand. Benchmark forecasts total demand in 2021 to be 430kt on an LCE basis.

Benchmark further expects the market to remain in a structural deficit for the foreseeable future as demand gets a head-start on supply. In the near impossible scenario that all projects come online on time as planned and without any issues, the first surplus will not occur until 2025. Benchmark believes that in this extreme case, a surplus could only be expected to last a few years before demand forces the market into a large deficit without further new projects yet undiscovered or developed.

Figure 8 –Lithium hydroxide supply demand forecast

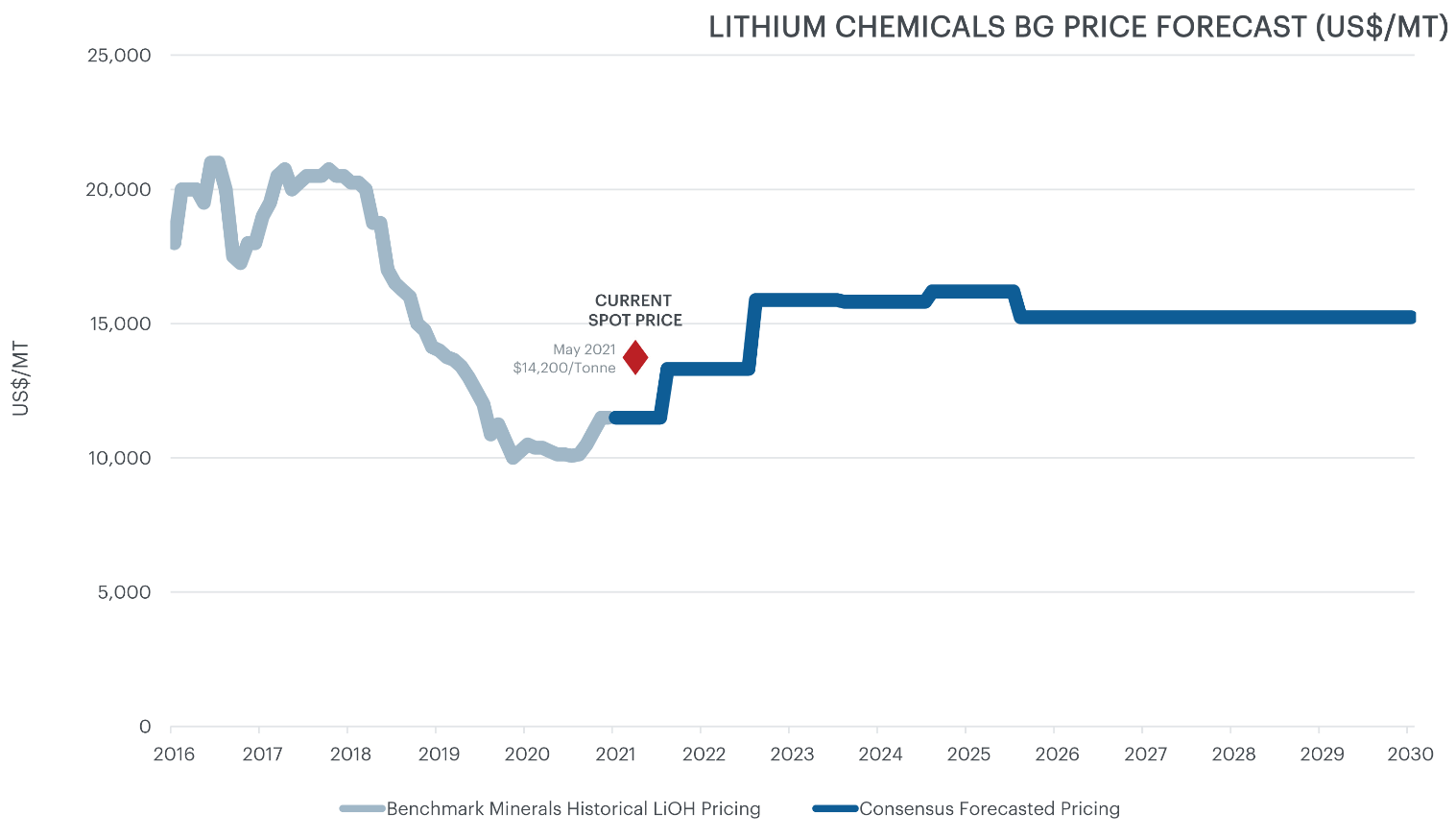

This Study assumes battery-grade lithium hydroxide and SC6 prices which reflect the median of consensus estimates from Benchmark Minerals, Roskill, Canaccord, Evercore, JPMorgan and Macquarie for the 2022-2026 period with fixed long-term pricing of $15,239/t for lithium hydroxide and $762/t for spodumene concentrate from 2027 onwards.

Figure 9 –Battery Grade (“BG”) lithium hydroxide pricing

Market Strategy

Piedmont is focused on establishing strategic partnerships with customers for battery grade lithium hydroxide with an emphasis on a customer base which is focused on EV demand growth in North America and Europe. Piedmont will concentrate this effort on these growing EV supply chains, particularly in light of the growing commitments of battery manufacturing by groups such as Ford, General Motors, LGES, Northvolt, SK Innovation, Volkswagen and others. Advanced discussions with prospective customers are ongoing.

By-Product Marketing

Piedmont proposes to produce quartz, feldspar and mica as by-products of spodumene concentrate operations. The Company engaged John Walker, an independent consultant, and Pronto Minerals, a joint venture between the Company and Ion Carbon & Materials, to assist the Company in estimating market opportunities for its by-products as shown in Table 10 below.

|

Table 10: Market Forecasts and Basket Pricing for By-Products (US$/t) | |||

|

Quartz (t/y) |

Feldspar (t/y) |

Mica(t/y) |

Average Realized Price ($/t) Mine Gate |

|

252,000 |

392,000 |

69,700 |

$79.50 |

Operating Cost Estimate

Spodumene Concentrate Operating Cost Estimate

The SC6 operating cost estimate was prepared based on operating at approximately 1.95 million t/y run-of-mine ore producing an average of 248,000 t/y of SC6. Table 11 summarizes the estimated operating costs at steady-state. Costs are presented on an FOB chemical plant basis. Calcium carbonate and aluminosilicate by-products from lithium hydroxide manufacturing are assumed to have zero credit value.

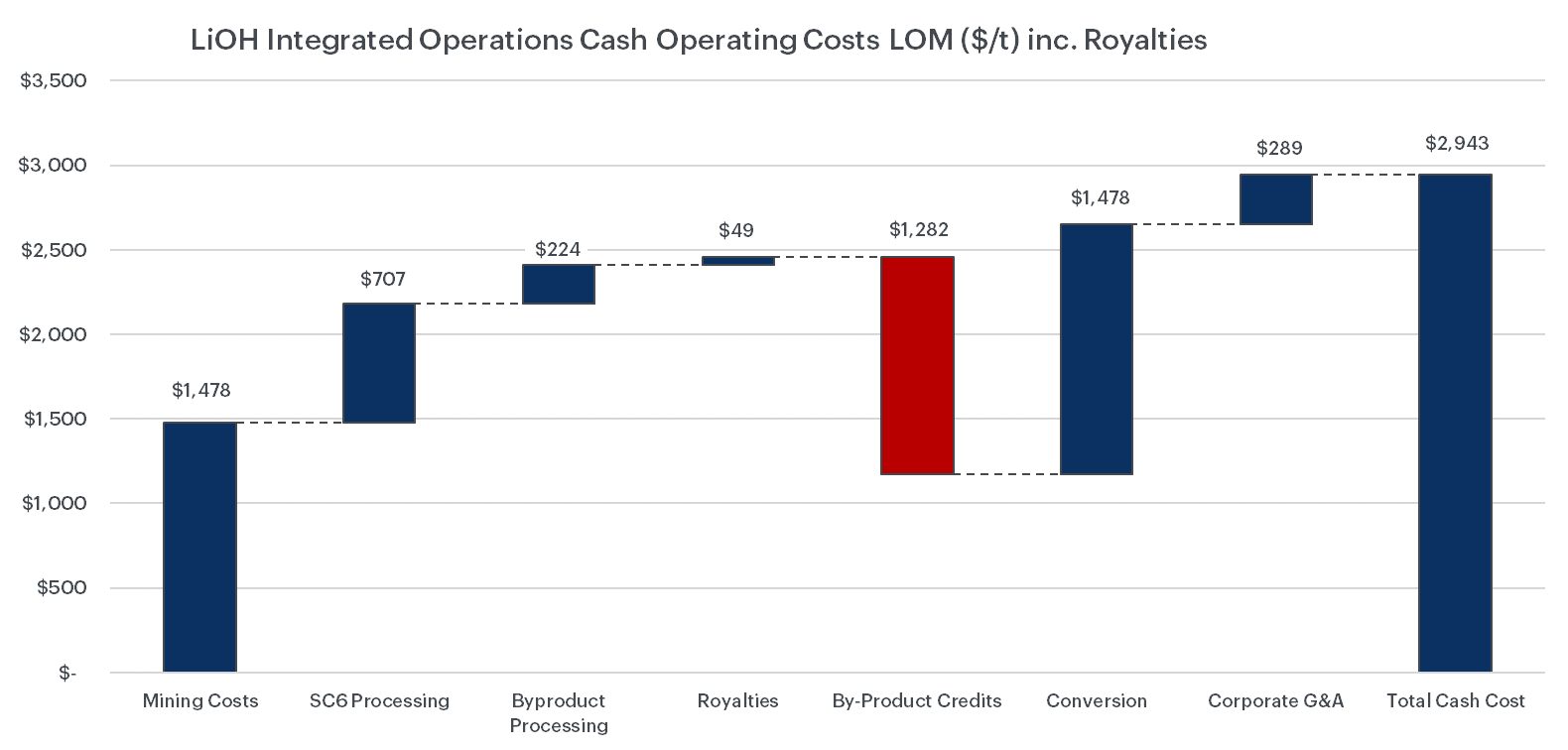

Lithium Hydroxide Operating Cost Estimate

The operating cost estimate was prepared based on producing 30,000 t/y of lithium hydroxide monohydrate. Table 12 summarizes the estimated average operating costs over life-of-mine.

|

Operating Cost Component |

Total Average Annual Cost (US$MM/y) |

Cost US$/t LiOH |

|---|---|---|

|

Salaries |

$9.3 |

$317 |

|

Reagents |

$19.0 |

$656 |

|

Consumables |

$1.0 |

$35 |

|

Utilities |

$7.4 |

$254 |

|

Maintenance |

$3.5 |

$122 |

|

Water and wastewater treatment |

$1.0 |

$33 |

|

Chemical plant overheads |

$1.8 |

$61 |

|

Subtotal conversion costs |

$43.0 |

$1,478 |

|

SC6 supply costs (cash cost basis) |

$34.2 |

$1,176 |

|

Corporate G&A |

$8.0 |

$289 |

|

Total cash operating costs |

$85.2 |

$2,943 |

The operating cost estimate is based on 2021 U.S. dollars with no escalation. Target accuracy of the operating cost estimate is ± 35%. Operating costs are based on steady-state production. The average operating costs include the commissioning and ramp-up phases of both concentrate operations and chemical plant operations. Third party SC6 sales are not included in the by-product credits.

Figure 10 – Lithium hydroxide production average life-of-mine cash operating cost

Capital Cost Estimate

Table 13 highlights the total estimated capital expenditures for the Project. A 20% contingency has been carried on costs in the economic modelling of the Project except where contracted values, such as land expenses, have been defined.

|

Cost Center |

Life-of-mine total (US$ million) |

|---|---|

|

Mine establishment and infrastructure direct costs |

$67.0 |

|

In-pit crushing and conveyors |

$52.1 |

|

Spodumene concentrator |

$115.2 |

|

By-products plant |

$39.0 |

|

Chemical plant |

$277.3 |

|

Project indirects |

$88.4 |

|

Total |

$639.0 |

|

Land acquisition |

$28.0 |

|

Other owner’s costs |

$43.8 |

|

Total Initial Capital (Excluding Contingency) |

$710.8 |

|

Contingency |

$127.8 |

|

Total Development Capital |

$838.6 |

|

Deferred and sustaining capital |

$337.9 |

|

Working capital |

$48.3 |

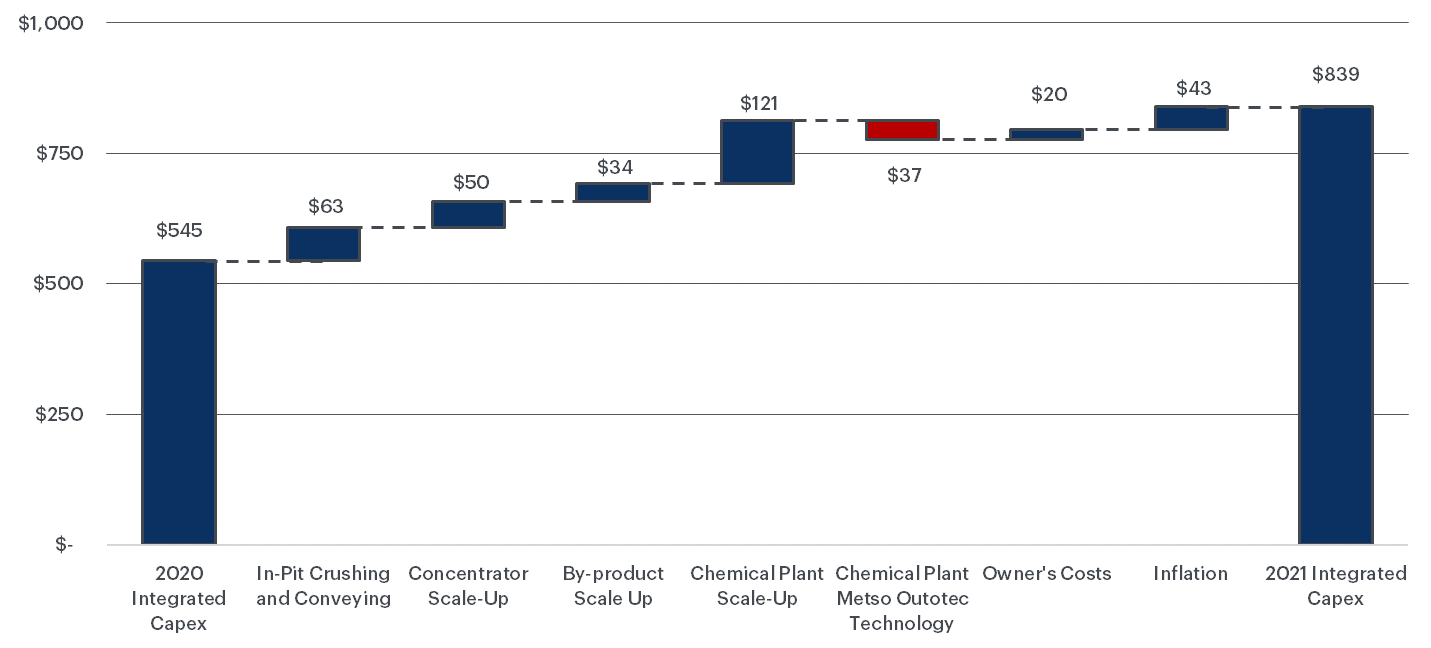

Figure 11 illustrates the change in capital costs from May 2020 to June 2021 including capital costs attributable to increased production rate, scope changes including adaptation of in-pit crushing and conveyor systems to improve operating costs and reduce environmental impacts, and inflationary impacts.

Figure 11 – Change in estimated project capital cost due to project scale, ESG initiatives, and inflation adjustment

Project Schedule

A preliminary schedule was prepared as part of the Study. At a scoping level of project detail, schedule development is limited to high level activities including feasibility study, detailed engineering, procurement of long lead items, critical contract formation and award, construction, and pre-operational testing activities. Key milestones are presented in Table 14. An updated schedule will be developed as part of the ongoing DFS.

Royalties, Taxes, Depreciation, and Depletion

The Scoping Study project economics include the following key parameters related to royalties, tax, depreciation, and depletion allowances.

- Royalties of US$1.00 per ROM tonne based on the average land option agreement

- North Carolina state corporate taxes are 2.5%

- Federal tax rate of 21% is applied and state corporate taxes are deductible from this rate

- Effective base tax rate of 22.975%

- Depletion allowance of 22% is applied to the spodumene concentrate sales price

- Depletion allowances for quartz, feldspar, and mica concentrates are assumed as 15%

- Depreciation in the concentrate operations is based on Asset Class 10.0 – Mining in IRS Table B-1 using the general depreciation system (“GDS”) over 7 years with the double declining balance method

- Depreciation in the chemical plant is based on Asset Class 28.0 – Mfg. of Chemical and Allied Products in Table B-1 using GDS of 5 years with the double declining balance method

- Bonus depreciation of 80% has been applied based on the bonus depreciation allowance in the Tax Cuts and Jobs Act assuming a place in service date of the concentrate operations and chemical plant by December 31, 2023

Scoping Study Economics

Modeling Assumptions

- A detailed project economical model was completed by the Company as part of the Study.

- Capital and operating costs are in accordance with technical study outcomes

- Chemical plant ramp-up is based on a 12-month time frame to nameplate production

- Financial modeling has been completed on a monthly basis, including estimated cash flow for construction activities and project ramp-up.

- Pricing information for battery-grade lithium hydroxide sales and spodumene concentrate supply are based on long-term forecasts using a basket of long-term forecasts provided by Benchmark, Roskill Canaccord, Evercore, JPMorgan and Macquarie

- Royalties, tax, depreciation, and depletion allowances according to stated assumptions

Financial Modelling

A comprehensive economic model has been prepared which fully integrates the Piedmont Carolina Lithium Project including concentrate and chemical operations. The Study assumes a chemical plant production life of 20 years commencing 3 months after the start of mining operations. The mining production target is approximately 37.4 Mt at an average run of mine grade of 1.09% Li2O (undiluted) over a 20-year mine life. The overall project life is 20 years.

The current economic model is based on a monthly projection of capital costs and assumes that the full capital cost is spent across 21 months prior to commissioning of the concentrate operations and across 24 months prior to the commissioning of the chemical plant. Concentrate operations are assumed to ramp to full production over a one-year period and the chemical plant is also assumed to ramp to full production over a one-year period.

Payback Period

Payback periods for the Project constructed in a single phase is 2.9 years after the start of chemical plant operations or 4.9 years from the start of construction. Payback period is calculated on the basis of after-tax free cash flow.

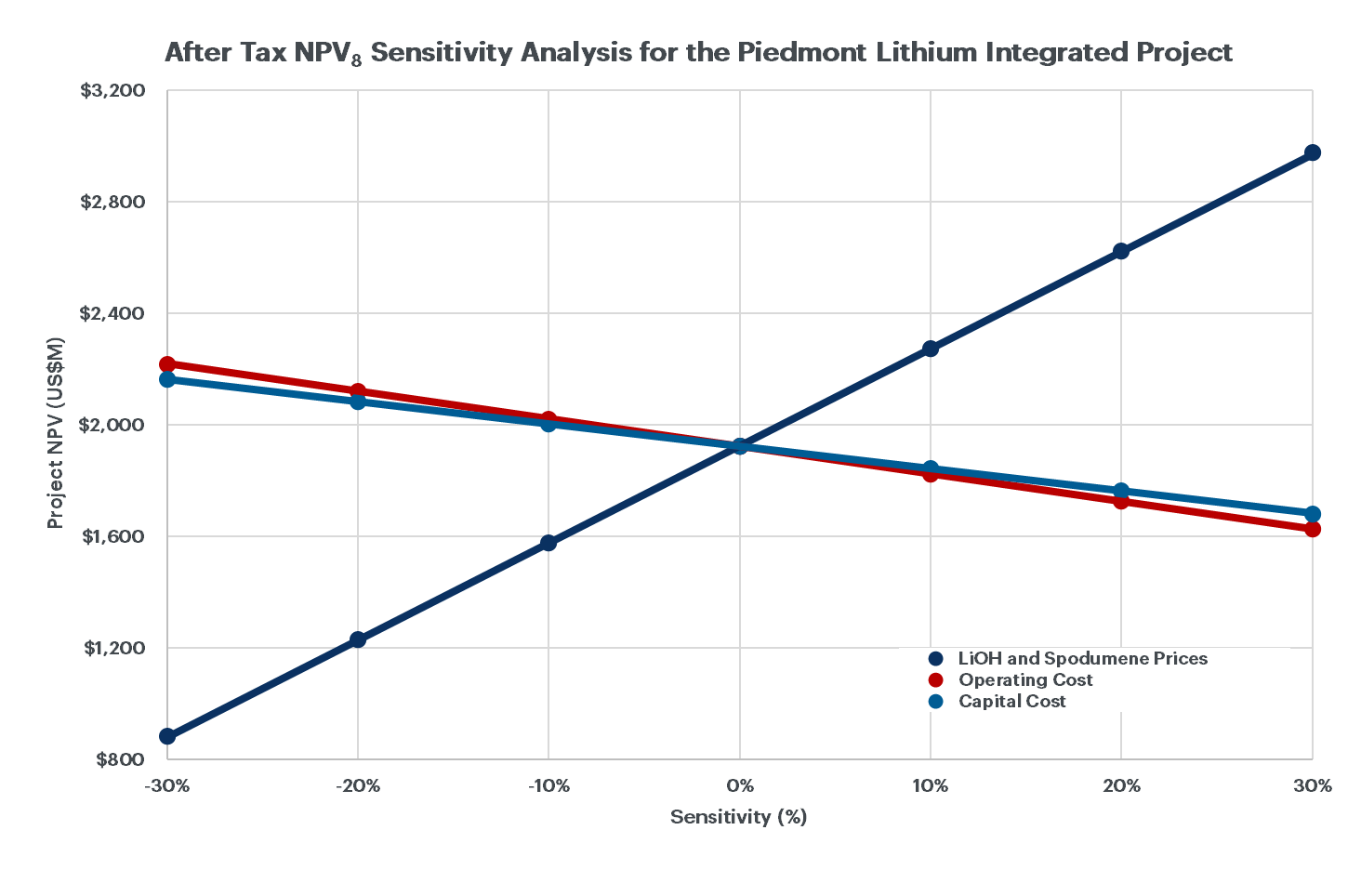

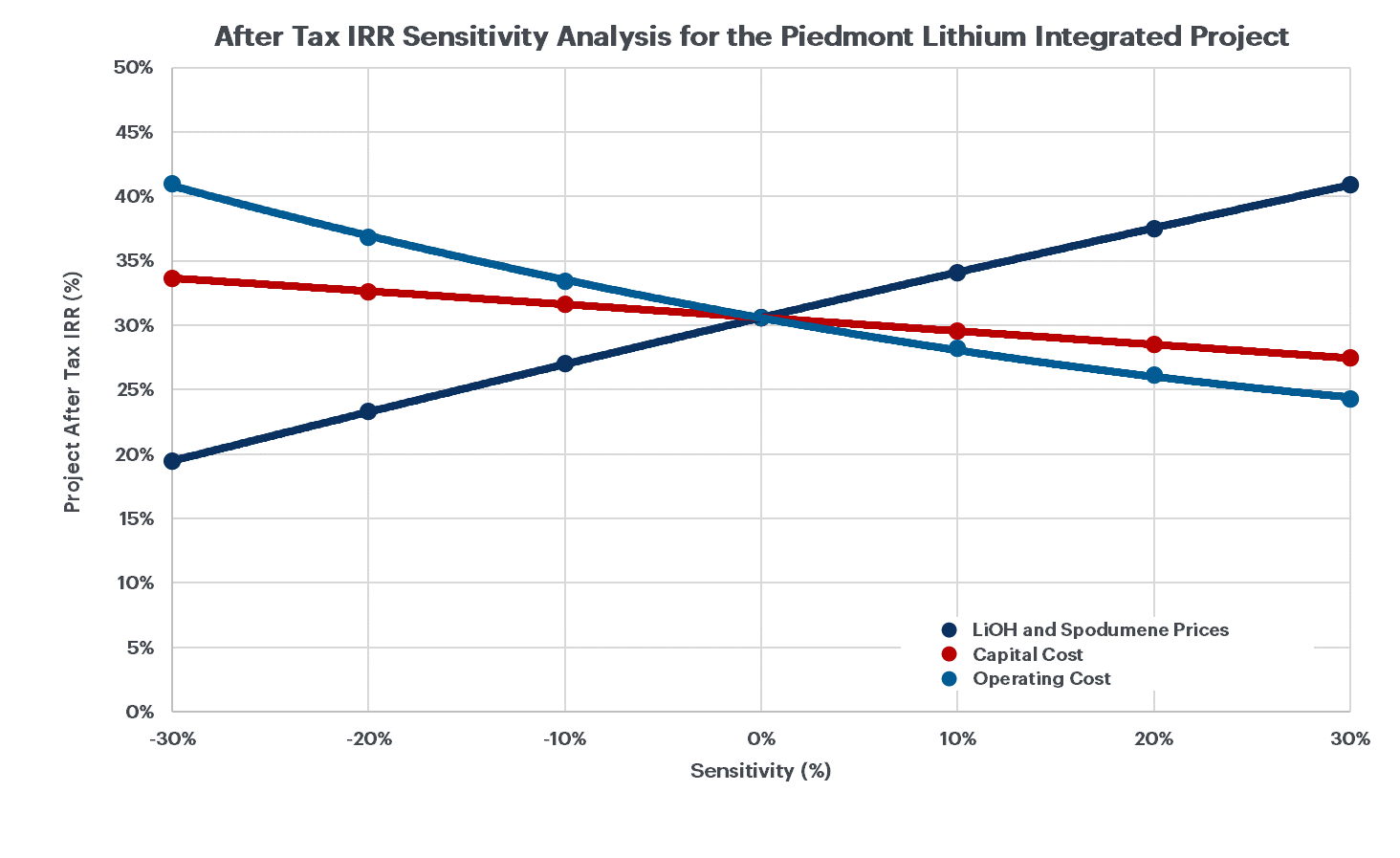

Sensitivity Analyses

The concentrate operations and chemical plant components of the Study have been designed to a Scoping level of detail with an intended accuracy of ± 35%. Key inputs into the Study have been tested by pricing, capital cost, and operating cost sensitivities (Figure 12 and Figure 13).

Figure 12 – Net present value sensitivity analysis for the Piedmont Carolina Lithium Project

Figure 13 – Internal rate of return sensitivity analysis for the Piedmont Carolina Lithium Project

Conclusions and Next Steps

The Study results demonstrate the potential for Piedmont to become a major North American lithium hydroxide producer on a fully integrated spodumene mine to lithium hydroxide chemical plant basis. The Company will now concentrate on the following initiatives to drive the Project forward:

- Finalize the pilot scale lithium hydroxide conversion testwork currently underway with Metso Outotec

- Conclude a definitive feasibility study of the Piedmont Carolina Lithium Project in 2021

- Continue to build out the Company’s leadership team consistent with the efforts in 2021 to date

- Engage in further pre-application consultation with Gaston County and the State of North Carolina in advance of submittal of rezoning and mine permit applications

- Submit a new air permit application for the proposed 30,000 t/y Gaston County chemical plant

- Evaluate strategic partnering options in partnership with Evercore and JP Morgan

Forward Looking Statements

This announcement may include forward-looking statements. These forward-looking statements are based on Piedmont’s expectations and beliefs concerning future events. Forward looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of Piedmont, which could cause actual results to differ materially from such statements. Piedmont makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect the circumstances or events after the date of that announcement.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources

The information contained herein has been prepared in accordance with the requirements of the securities laws in effect in Australia, which differ from the requirements of United States securities laws. The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Australian mining terms defined in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the “JORC Code”). Comparable terms are now also defined by the U.S. Securities and Exchange Commission (“SEC”) in its newly adopted Modernization of Property Disclosures for Mining Registrants as promogulated in its S-K 1300 standards. While the guidelines for reporting mineral resources, including subcategories of measured, indicated, and inferred resources, are largely similar for JORC and S-K 1300 standards, documentation is ongoing with respect to the S-K 1300 Technical Report Summary template to formally categorize Piedmont’s mineral holdings as both JORC and S-K 1300 compatible. While the competent persons responsible for this announcement do not foresee any challenges in categorizing the resources delineated in this announcement as S-K 1300 compliant, information contained herein that describes Piedmont’s mineral deposits is not fully comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. U.S. investors are urged to consider Piedmont’s disclosure in its SEC filings, copies of which may be obtained from Piedmont or from the EDGAR system on the SEC’s website at http://www.sec.gov/.

Competent Persons Statements

The information in this announcement that relates to Exploration Results is based on, and fairly represents, information compiled or reviewed by Mr. Lamont Leatherman, a Competent Person who is a Registered Member of the ‘Society for Mining, Metallurgy and Exploration’, a ‘Recognized Professional Organization’ (RPO). Mr. Leatherman is an employee of the Company. Mr. Leatherman has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr. Leatherman consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The information in this announcement that relates to lithium Mineral Resources is extracted from our announcement entitled “Piedmont Increases Lithium Resources by 40%” dated April 8, 2021. The information in this announcement that relates to by-product Mineral Resources is extracted from our announcement entitled “Piedmont Focused on Increased Sustainability with 40% Increase in Quartz, Feldspar, and Mica Mineral Resources” dated June 8, 2021. Both announcements are available to view on the Company website at www.piedmontlithium.com. Piedmont confirms that: a) it is not aware of any new information or data that materially affects the information included in the original announcements; b) all material assumptions and technical parameters underpinning the Mineral Resources in the original announcements continue to apply and have not materially changed; and c) the form and context in which the Competent Person’s findings are presented in this announcement have not been materially modified from the original announcements.

The information in this announcement that relates to Metallurgical Testwork Results is based on, and fairly represents, information compiled or reviewed by Dr. Jarrett Quinn, a Competent Person who is a Registered Member of Ordre des Ingénieurs du Québec’, a ‘Recognized Professional Organization’ (RPO). Dr. Quinn is consultant to Primero Group. Dr. Quinn has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Mineral Resources and Ore Reserves’. Dr. Quinn consents to the inclusion in the report of the matters based on information in the form and context in which it appears.

The information in this announcement that relates to Process Design, Capital Costs, and Operating Costs is based on, and fairly represents, information compiled or reviewed by Mr. Alexandre Roy, a Competent Person who is a Registered Member of ‘Ordres des Ingenieurs du Quebec’, a ‘Recognized Professional Organization’ (RPO). Mr. Roy is a full time employee of Primero Group. Mr. Roy has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Mineral Resources and Ore Reserves’. Mr. Roy consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.

The information in this announcement that relates to Mining Engineering and Mining Schedule is based on information compiled by Mr. Chris Scott and reviewed by Dr. Steven Keim, both of whom are employees of Marshall Miller and Associates (MM&A). Dr. Keim takes overall responsibility as Competent Person for the portions of the work completed by MM&A. Dr. Steven Keim is a Competent Person who is a Registered Member of the ‘Society for Mining, Metallurgy & Exploration Society’, a ‘Recognized Professional Organization’ (RPO). Dr. Keim has sufficient experience, which is relevant to the style of mineral extraction under consideration, and to the activity he is undertaking, to qualify as Competent Person in terms of the JORC Code (2012 Edition). Dr. Keim has reviewed this document and consents to the inclusion in this report of the matters based on his information in the form and context within which it appears.

This announcement has been authorized for release by the Company’s CEO, Mr. Keith Phillips.