- Piedmont and Primero have entered into an MOU for the delivery of the proposed Piedmont spodumene concentrator on an Engineer, Procure, and Construct (“EPC”) basis

- Primero to contract operate the spodumene concentrator for a period of up to six years following construction

- Primero is a world leader in the design, construction, and operations of spodumene concentrator projects

- MOU significantly mitigates the execution risk of Piedmont’s integrated lithium hydroxide business

NEW YORK –

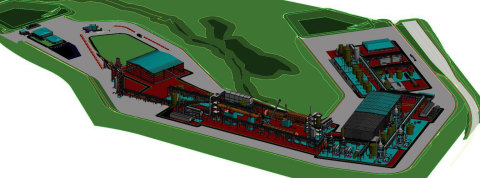

Piedmont Lithium Limited (“Piedmont” or “Company”) is pleased to report that the Company has entered into a memorandum of understanding (“MOU”) with Primero Group (“Primero”) relating to the Company’s planned spodumene concentrator located in the historic Carolina Tin-Spodumene Belt in North Carolina, USA.

Piedmont and Primero have partnered since early 2018 and Primero has been the lead engineering consultant for Piedmont’s scoping studies, concentrator design, and metallurgical testwork management. Building on this strong relationship, Piedmont and Primero have entered into the MOU to work together on an exclusive basis to agree binding documentation relating to the definitive feasibility study (“DFS”), front-end engineering design, EPC delivery, commissioning, ramp-up and contract operations of the spodumene concentrator.

The EPC and operations contract models contemplated by the MOU provide incentives for Primero to achieve safety, schedule, budget, process performance, production, and recovery targets. The arrangements contemplated by the MOU create a delivery framework which significantly reduces technical, operational and commercial risks associated with the concentrator. The Company continues to evaluate other strategic partnerships that could enhance performance in the design, construction and operations of other aspects of Piedmont’s integrated lithium hydroxide business.

Primero is recognized as a world leader in the design, construction, optimization, and contract operations of spodumene projects globally. Primero’s client list includes the existing operations of Pilbara Minerals, Altura, Alliance Minerals and Galaxy and engineering services performed for Sigma Lithium, Savannah Resources, Core Lithium and many others. Primero’s EPC and contract operations services at Alliance Minerals’ Bald Hill mine notably achieved nameplate capacity within two months of plant commissioning.

Cam Henry, Managing Director of Primero commented: “Piedmont is a world-class project surrounded by infrastructure and ideally located near potential customers in the USA’s auto alley. We are excited to continue the relationship we have established with Piedmont Lithium over the past three years and we look forward to applying our specialist expertise in project implementation and operations to assist Piedmont in advancing the only spodumene project currently under development in the United States.”

Keith D. Phillips, President and CEO of Piedmont, commented: “We are very pleased to be working with Primero as we advance our integrated lithium hydroxide project. Primero is the world-leader in the design, construction and operation of spodumene concentrate plants, with extensive involvement in many of the producing operations in Western Australia and leadership roles in projects in Canada, Brazil and Portugal. This is a key milestone as we build out our project execution team, with an emphasis on working with proven processes and experienced professionals.”

To view the full ASX Announcement, click here.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200623005240/en/

Keith D. Phillips

President & CEO

T: +1 973 809 0505

E: kphillips@piedmontlithium.com

Timothy McKenna

Investor and Government Relations

T: +1 732 331 6457