NEW YORK – Piedmont Lithium Limited (ASX:PLL; NASDAQ:PLL) (“Piedmont” or “Company”) is pleased to present its June 2020 quarterly report. Highlights during and subsequent to the quarter were:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200730005130/en/

Figure 1: Piedmont Lithium project located within the TSB (Graphic: Business Wire)

- Completed a pre-feasibility study (“PFS”) for Piedmont’s proposed lithium hydroxide chemical plant (“Chemical Plant”) in Kings Mountain, North Carolina, USA. The PFS highlighted a business model where a Piedmont built and owned Chemical Plant would convert spodumene concentrate purchased on the global market to battery-grade lithium hydroxide.

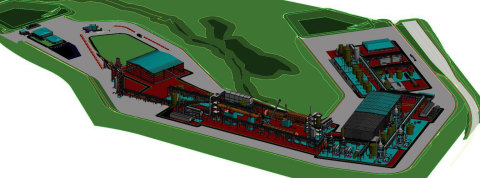

- Completed an updated scoping study for Piedmont’s integrated mine-to-hydroxide project. The mine-to-hydroxide project comprises a mine and concentrator producing spodumene concentrate which will be transported to Piedmont’s Chemical Plant and converted into battery-grade lithium hydroxide. The updated scoping study includes the results of the new Chemical Plant PFS.

- Completed additional metallurgical testwork to produce 120 kilograms of spodumene concentrate from core samples collected from the Piedmont Lithium Project. Concentrate qualities and recoveries were consistent with earlier testwork programs.

- Completed a bench-scale lithium hydroxide testwork program at SGS Canada, Inc. in Lakefield, Ontario which demonstrated conversion of Piedmont ore to battery-quality lithium hydroxide.

- Entered into a memorandum of understanding (“MOU”) with Primero Group (“Primero”) for the delivery of Piedmont’s planned spodumene concentrator on an engineer, procure, and construct (“EPC”) basis, with Primero to contract operate the spodumene concentrator for a period of up to six years following construction.

- Concluded a definitive and exclusive marketing agreement for byproduct quartz, feldspar, and mica with Ion Carbon, a division of AMCI. The Company continues to advance offtake discussions for byproducts with quartz offtake discussions the most advanced.

- Appointed Mr. Austin Devaney as Vice President – Sales & Marketing. Mr. Devaney spent most of the past decade in senior marketing roles with Albemarle Corporation, most recently as Vice President, Strategic Marketing and Customer Excellence.

- Completed a U.S. public offering of 2,065,000 of its American Depositary Shares (“ADSs”), each representing 100 of its ordinary shares, including the exercise of the underwriters’ over-allotment option, at an issue price of US$6.30 per ADS, to raise gross proceeds of US$13.0 million (~A$18.6 million) (“Public Offering”).

- Piedmont has also received commitments from existing non-U.S. institutional and sophisticated shareholders and directors for 120,000,000 of its fully paid ordinary shares, at an issue price of A$0.09 per share (which equates to the same issue price of the Public Offering), to raise gross proceeds of A$10.8 million (“Private Placement”). Completion of the Private Placement is subject to shareholder approval.

Keith D. Philips, President and CEO of Piedmont commented “We are extremely pleased with the progress the Company has made during the quarter on advancing our 100% owned Piedmont Lithium Project. The PFS and scoping studies both demonstrate the economic benefit of developing a lithium chemical business in North Carolina, USA given its exceptional infrastructure, low operating costs and competitive tax regime.

“We continue to build a world-class team to support the project development. The appointment of Austin Devaney, one of the world’s most experienced lithium marketing professionals, significantly improves the Company’s lithium marketing experience. Primero’s extensive skill set in the construction and operation of spodumene concentrate plants adds considerable technical experience and de-risks that aspect of our project.

“Piedmont’s robust balance sheet provides the ability for the company to continue to progress the development the Kings Mountain site. We will be actively working on a Definitive Feasibility Study in coming months and I look forward to updating the market in due course.”

Click here to view the full ASX Announcement.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200730005130/en/

Keith Phillips

President & CEO

+1 973 809 0505

Tim McKenna

Investor and Government Relations

+1 732 331 6457